Second Opinion®

Trade Trigger

: BANKUNITED, INC. (BKU)

Trade Trigger stocks are breaking through significant resistance (bullish) or support (bearish) areas.

Second Opinion®

Trade Trigger

: BANKUNITED, INC. (BKU)

Trade Trigger stocks are breaking through significant resistance (bullish) or support (bearish) areas.

Report created after market close on 10/31/25

Report created after market close on 10/31/25

Neutral

MarketEdge® Second Opinion

From Avoid on 10/10/2025

Price At Upgrade

0.1%

0.1%

Change Since Upgrade

Recommendation

Trade Activity for: 10/31/25

Close |

40.08 |

Change |

0.22 |

Volume |

10747 |

Open |

39.5 |

High |

40.22 |

Low |

38.9 |

MarketEdge Indicators

Opinion Score |

Power Rating |

Mildly Improving |

Bearish

Bullish

40 |

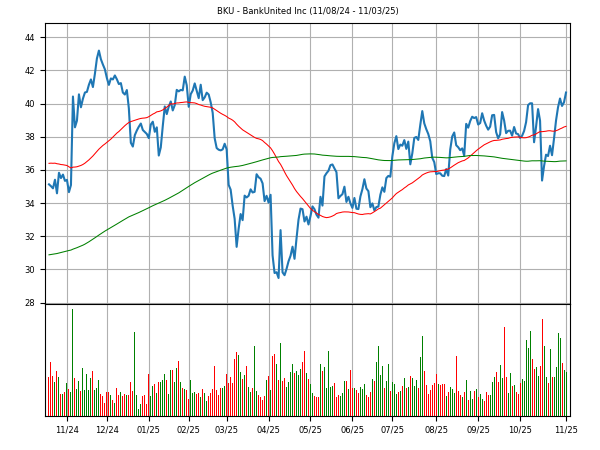

Annual Chart

33% Off for Schwab Customers - $19.95/mo.

Comment

Over the last 50 trading days, when compared to the S&P 500, the stock has performed in line with the market. BKU's chart formation suggests an upward trend is beginning. stock is in the early stages of a rising trend. A close above $40.1 is a number to watch to confirm a trend reversal.Momentum as measured by the 14-day RSI is positive but showing signs of slowing. Over the last 50 trading sessions, there has been more volume on up days than on down days, indicating that BKU is under accumulation, which is a bullish condition. The stock is trading above a rising 50-day moving average which confirms the improving technical condition. BKU is above its rising 200-day moving average which is pointed up adding to the stocks improving technical condition.

Subscribe to MarketEdge to get our daily comment for BKU.

Yr. High/Yr. Low |

44.45 | 28.21 | |

MO Chg.(%) |

4.5% | ||

Trend Line Resistance |

0 |

Trend Line Support |

0 |

|---|---|---|---|

Entry Price |

40.1 | ||

Volatility(%) |

3.8 | ||

Position |

79 | ||

ADXR |

33 | ||

Avg Volume(00) |

13541 | ||

MO Chg.(%) |

63.4% | ||

U/D Ratio/Slope |

1.7 | Up | |

On Balance Volume |

Bullish | ||

Positive OBV |

Bullish | ||

Negative OBV |

Bullish | ||

Money Flow (MF) |

62 | ||

MF Slope |

Bullish | ||

Alpha/Beta |

0 | 1.35 | |

B.Bands |

16 | ||

MACD ST/LT |

Bullish | Bearish | |

50-Day R.S. |

1.01 | ||

Wilder's RSI |

58 | ||

Sto. Fast/Slow |

58 | 69 | |

OBOS/RSV |

0 | 68 | |

C-Rate |

0 | ||

| Moving Average | Price | % | Slope |

|---|---|---|---|

| 10 Day | 38.5 | 104 | Up |

| 21 Day | 38.51 | 104 | Up |

| 50 Day | 38.59 | 104 | Up |

| 200 Day | 36.54 | 110 | Up |

Past performance is not a guarantee of future results. The data contained in MarketEdge is obtained from sources considered by Computrade Systems, Inc. to be reliable but the accuracy and completeness thereof are not guaranteed. Computrade Systems, Inc. does not and will not warrant the performance and results that may be obtained while using the MarketEdge research service. The MarketEdge research service & Second Opinion are neither offers to sell nor solicitations of offers to buy any security. Company profile, estimates and financials provided by S&P Global See User Agreement for other disclaimers. MarketEdge and Second Opinion are registered trademarks of Computrade Systems, Inc. © 2018 Computrade Systems, Inc.© 2018 The McGraw-Hill Companies, Inc. S&P Global is a division of The McGraw-Hill Companies, Inc. See full Copyright for details.