Second Opinion®

Trade Trigger

: EXPRO GROUP HOLDINGS N.V. (XPRO)

Trade Trigger stocks are breaking through significant resistance (bullish) or support (bearish) areas.

Second Opinion®

Trade Trigger

: EXPRO GROUP HOLDINGS N.V. (XPRO)

Trade Trigger stocks are breaking through significant resistance (bullish) or support (bearish) areas.

Report created after market close on 12/19/25

Report created after market close on 12/19/25

Neutral

MarketEdge® Second Opinion

From Long on 12/19/2025

Price At Downgrade

3.6%

3.6%

Change Since Downgrade

Recommendation

Trade Activity for: 12/19/25

Close |

12.97 |

Change |

0.45 |

Volume |

55746 |

Open |

12.54 |

High |

13 |

Low |

12.53 |

MarketEdge Indicators

Opinion Score |

Power Rating |

Mildly Deteriorating |

Bearish

Bullish

-13 |

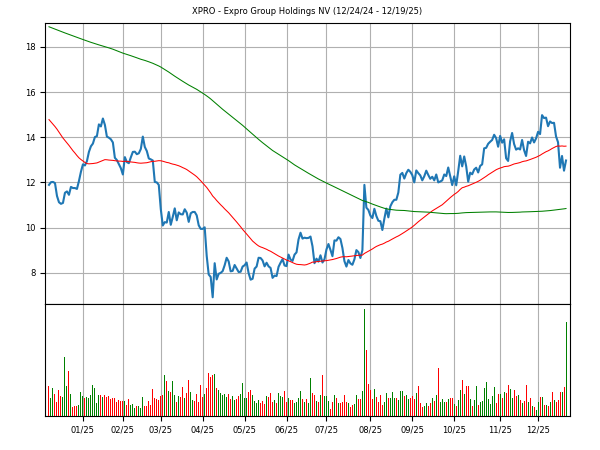

Annual Chart

33% Off for Schwab Customers - $19.95/mo.

Comment

Over the last 50 trading days, when compared to the S&P 500, the stock has performed in line with the market. The MACD-LT, an intermediate-term trend indicator, is bearish at this time. XPRO's chart formation is showing signs of reversing its recent trend. If the stock closes below $12.9 a change in trend will be confirmed.Over the last 50 trading sessions, there has been more volume on down days than on up days, indicating that XPRO is under distribution, which is a bearish condition. The 50-day moving average is pointed up but the stock is trading below this important support level which is bearish. XPRO could find secondary support at its rising 200-day moving average.

Subscribe to MarketEdge to get our daily comment for XPRO.

Yr. High/Yr. Low |

15.04 | 6.69 | |

MO Chg.(%) |

-1.5% | ||

Trend Line Resistance |

0 |

Trend Line Support |

13.4 |

|---|---|---|---|

Buy Stop |

12.9 | ||

Volatility(%) |

3.7 | ||

Position |

20 | ||

ADXR |

26 | ||

Avg Volume(00) |

11861 | ||

MO Chg.(%) |

-5.7% | ||

U/D Ratio/Slope |

1.3 | Down | |

On Balance Volume |

Bullish | ||

Positive OBV |

Bearish | ||

Negative OBV |

Bullish | ||

Money Flow (MF) |

58 | ||

MF Slope |

Bearish | ||

Alpha/Beta |

0 | 1.55 | |

B.Bands |

21 | ||

MACD ST/LT |

Bearish | Bearish | |

50-Day R.S. |

1.01 | ||

Wilder's RSI |

42 | ||

Sto. Fast/Slow |

32 | 21 | |

OBOS/RSV |

1 | 72 | |

C-Rate |

0 | ||

| Moving Average | Price | % | Slope |

|---|---|---|---|

| 10 Day | 13.76 | 94 | Down |

| 21 Day | 13.96 | 93 | Down |

| 50 Day | 13.61 | 95 | Up |

| 200 Day | 10.84 | 120 | Up |

Past performance is not a guarantee of future results. The data contained in MarketEdge is obtained from sources considered by Computrade Systems, Inc. to be reliable but the accuracy and completeness thereof are not guaranteed. Computrade Systems, Inc. does not and will not warrant the performance and results that may be obtained while using the MarketEdge research service. The MarketEdge research service & Second Opinion are neither offers to sell nor solicitations of offers to buy any security. Company profile, estimates and financials provided by S&P Global See User Agreement for other disclaimers. MarketEdge and Second Opinion are registered trademarks of Computrade Systems, Inc. © 2018 Computrade Systems, Inc.© 2018 The McGraw-Hill Companies, Inc. S&P Global is a division of The McGraw-Hill Companies, Inc. See full Copyright for details.