The Right Stock At The Right Time®

The Right Stock At The Right Time® The Right Stock At The Right Time® The Right Stock At The Right Time® |

|

||

|

Stochastic Oscillators

The stochastic oscillator is very good at identifying overbought and oversold conditions. It compares where a security's price closed relative to its trading range over x-time periods. Values range from 0 to 100. Readings over 80 signal overbought conditions (bearish), while readings below 20 are regarded as an oversold situation (bullish).

There are two stochastic oscillators, Slow %K and Fast %K. Both are constructed by comparing a stocks closing price to its trading range over the five previous days. Slow %K is then smoothed with a three-day simple moving average while Fast %K does not. As might be expected, Fast %K is much more erratic than Slow %K and therefore not as reliable.

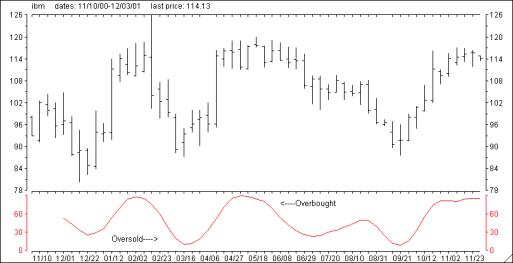

The graph located below is a weekly chart of IBM with the Slow %K stochastic oscillator plotted at the bottom. Both overbought (over 80) and oversold (under 20) areas are labeled. Note that the week ending 3/16/00, Slow %K dipped below 20 when IBM closed at 95. This represented a very oversold situation and an excellent time to purchase IBM shares. IBM proceeded to rally over the next six weeks, topping out at 118 as Slow %K soared to over 80 signaling another overbought condition.

The Stochastic oscillators work best when the market is in a trading range but should not be the basis for a trading system. Rather, they should be used to spot entry and exit points within the framework of a trading approach with an intermediate-term time frame. For example, let's assume a moving average system is used to signal when a stock is in an up trend. Using this approach, a position is initiated and would be held until the moving average system signal that the trend has reversed. By using the stochastic oscillator to spot overbought/oversold conditions, the stock could be traded several times over the same time period, capturing several profitable trades versus holding the position throughout. Both the Slow %K and Fast %K oscillators are located on the Market Edge "Second Opinion" reports. In addition, the Market Edge site contains several screening capabilities, which search for stocks that are either overbought or oversold based on the status of the stochastic oscillator.

|